The allure of gold has been around for a long time. People have been keeping the precious metal as a way to protect their wealth since the day of emperors and kings. Nowadays, people still find it valuable but many people prefer putting money in stocks and bonds. But some investors still trust in gold and find it a welcome refuge against all the chaos of the market. After all, gold will always have inherent value. If you’re thinking of buying and investing in gold, here are some pointers so that you don’t make costly mistakes:

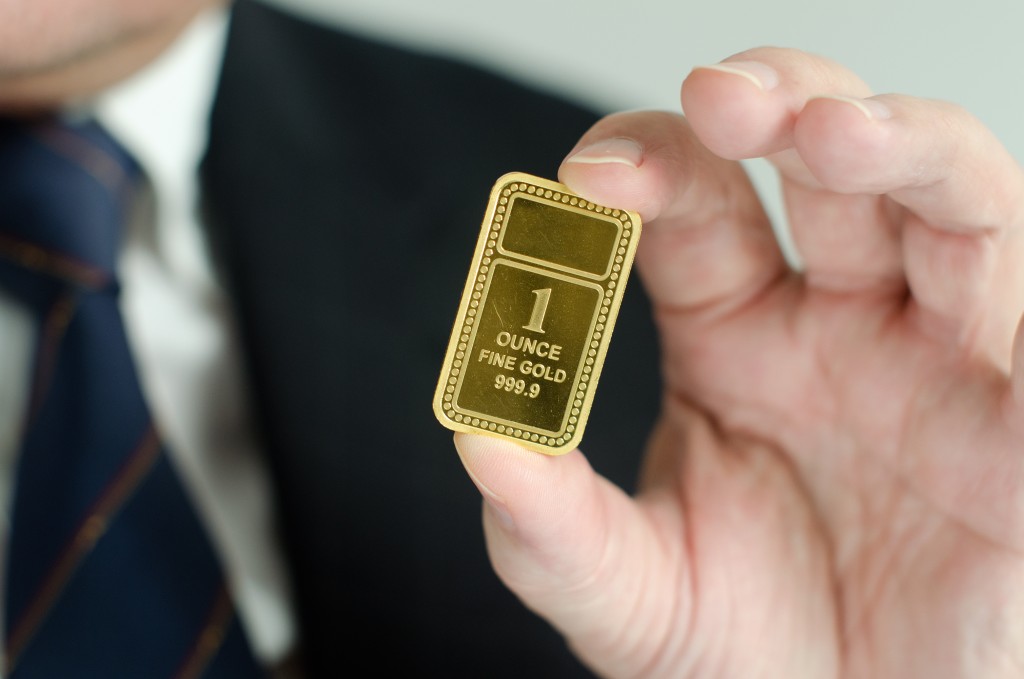

Get Actual Gold

The easiest way to invest in gold is to buy the real thing. You can buy gold bars, jewelry, and coins in various ways. There are many dealers out there who would be able to sell you what you want. There are several risks, though. You need to be sure about the source of your gold. For example, a dependable gold refinery is much different from fly-by-night operations in some countries in Africa or South America.

Fortunately, most dealers would be willing to inform you about who they are buying their gold from. The other risk that you have to be aware of is that gold prices can fluctuate. You might be buying gold at a high right now but it could easily drop. But there is also a chance it could get more expensive. You should also be aware of the fact that the gold you buy may get stolen so invest in some security.

Invest in Gold Futures

If you don’t want to risk hiding physical gold in your home or bank, then you can put money into gold futures. This means you are speculating about the price of gold. There are two advantages to this. First, this means that whether gold goes up or down, as long as you bet right, you should be able to profit. Second, you don’t have to buy gold futures with your present money. You can use leverage so that you can get more for a small sum. It is a bit risky though and a wrong bet can mean you owing a lot of money.

Buy Shares in a Gold Mining Company

Buy Shares in a Gold Mining Company

If you want to be safer with your money and see dividends from it, then buying shares of a mining company that focuses on gold is a great idea. You don’t make money from gold but the shares of the company. If the mine produces a large amount of gold, you can expect share value to go up. Additionally, if the gold value goes up, you can also expect an increase in stock price.

Go With Gold ETFs

Gold-based exchange-traded funds (ETFs) are the safest gold investment option. They work similarly to buying shares in gold companies but there is less risk for you. You put money into these managed funds and expert investors use the fund money to buy shares in various stocks in the gold industry. This spreads the risk around so you are cushioned a bit from potential losses.

Investing in gold is one of the most dependable ways to protect yourself financially. But it can still be risky and is not something everyone can do. But if you want something that doesn’t depend on fluctuating stocks, then gold can be the asset to put your money into.